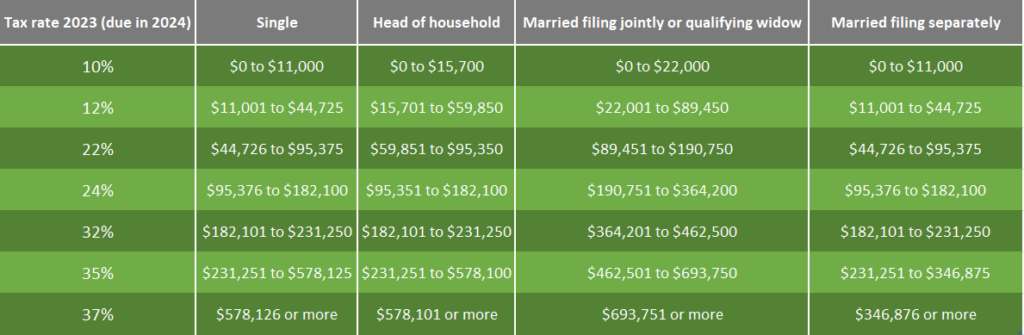

Due to soaring inflation, the IRS has announced changes for tax year 2023. The federal agency increased both the federal income tax brackets and the standard deductions to help taxpayers.

New Tax Brackets

Representative of what taxable income you fall under, the IRS has updated the federal tax brackets. For Single Individual: For tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125. For taxpayers Married and Filing Jointly: For tax year 2023, the top tax rate remains 37% with incomes greater than $693,750.

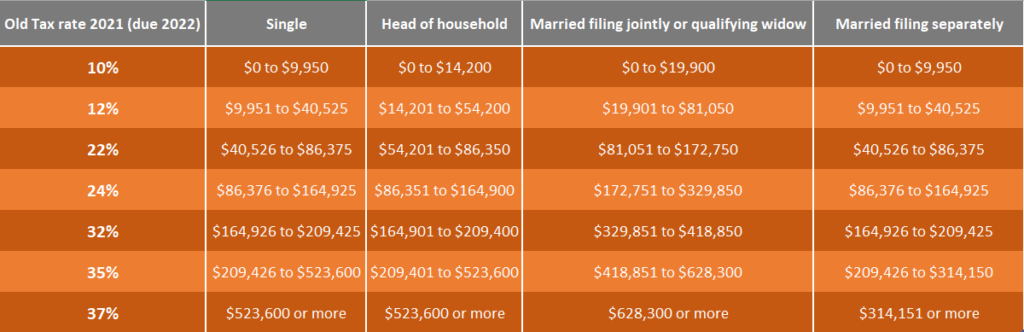

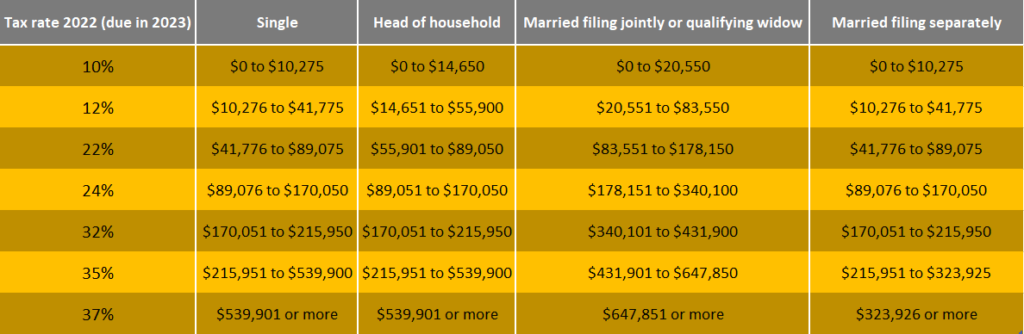

Here is a summary of the changes for the categories Single and Married Filing Jointly (Tax Returns Filed in 2023 will follow the yellow Tax Bracket of 2022 here):

For other tax bracket categories, you can visit the IRS for upcoming changes.

Higher Standard Deductions

How to reduce your tax bill? Both tax credits and tax deductions are common ways of reducing your tax bill.

Tax credits can reduce your tax bill when you are treating dollar-for-dollar basis; they don’t affect what bracket you’re in.

Tax deductions, separately, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. For instance, if your tax bracket is 22%, a $1,000 deduction could save you $220.

New IRS Changes

According to the IRS, the standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of household, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

Other IRS Adjustments

The IRS made several other adjustments which can be found on their website. US Tax Shield will be happy to assist and inform you of the recent changes while potentially representing you if you ever need tax help or tax filing.