Don’t Miss Out on Your Tax Refund: IRS Final Reminder

By US Tax Shield |

Are you one of the many taxpayers who could be missing out on a substantial tax refund from 2020? The ...

IRS Interest Rates Reach Record High – Affecting Millions: Take Action Now to Manage Your Tax Debt

By US Tax Shield |

The latest news from the IRS is sending shockwaves throughout the nation. In a significant development, the IRS has increased ...

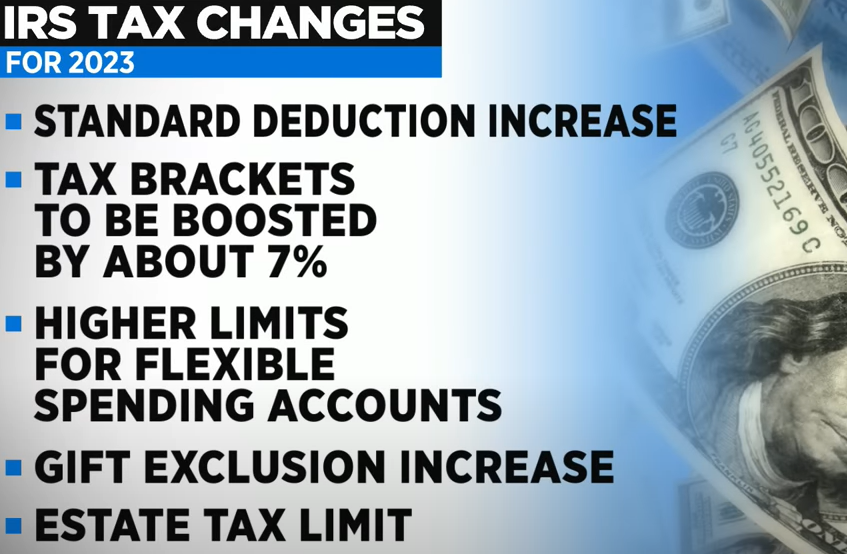

NEW IRS changes for tax year 2022 and 2023 due to inflation levels.

By US Tax Shield |

Due to soaring inflation, the IRS has announced changes for tax year 2023. The federal agency increased both the federal ...

Tax Extension Deadline – October 17

By US Tax Shield |

This year, nearly 19 million Americans asked for a tax extension. Or nearly 1 in 8 Americans had to ask ...

Inflation Reduction Act – New IRS Funding

By US Tax Shield |

The Inflation Reduction Act, intending to reduce inflation, has now passed the U.S. Senate earlier this month. While the bill ...

IRS Urges Taxpayers With Tax Extensions to File as Soon as Possible

By US Tax Shield |

The IRS is urging taxpayers who haven't filed their 2021 tax return to file their complete and accurate return electronically ...

Tax Considerations for Short-Term Rentals

By US Tax Shield |

Offering your home or a room in your home as a short-term rental through platforms like Airbnb, VRBO, HomeAway, FlipKey, ...

Claim Your 2018 Tax Refund Before it’s Gone

By US Tax Shield |

As the April tax deadline approaches, The IRS announced it has $1.5 billion worth of unclaimed tax refunds for more ...

Are Social Security Benefits Taxable?

By US Tax Shield |

Social Security is a federal program that promotes economic security for millions of Americans. With retirement, disability, and survivors benefits, ...

Understanding Cryptocurrency and Taxes

By US Tax Shield |

Understanding Cryptocurrency and Taxes As cryptocurrency continues to dominate the headlines and become a cash alternative, the IRS is turning ...

2022 Tax Filing Season Begins January 24th – Get Started Now

By US Tax Shield |

The 2022 tax filing season is quickly approaching. As IRS Commissioner Chuck Rettig notes, "Planning for the nation's filing season ...

Get a Jump Start on Your Taxes for 2022

By US Tax Shield |

On December 7th, the Internal Revenue Service recommended that taxpayers begin taking important steps this month to make filing taxes ...

401(k) Early Withdrawal

By US Tax Shield |

Looking to make an early withdrawal from your 401(k)? Before you jump the gun, take a look at some of ...

How to Deal With an IRS Revenue Officer

By US Tax Shield |

No one likes to have the IRS knocking on their door. It can be a scary and intimidating experience. If ...

What You Need To Know About Common Tax Penalties

By US Tax Shield |

No one wants the undesirable consequences of failing to pay taxes on time. Missing your first tax deadline will lead ...

Wage Garnishment, Levies, and Tax Liens

By US Tax Shield |

When a taxpayer owes money to the IRS, the IRS can collect the unpaid taxes, penalties, and interest in several ...

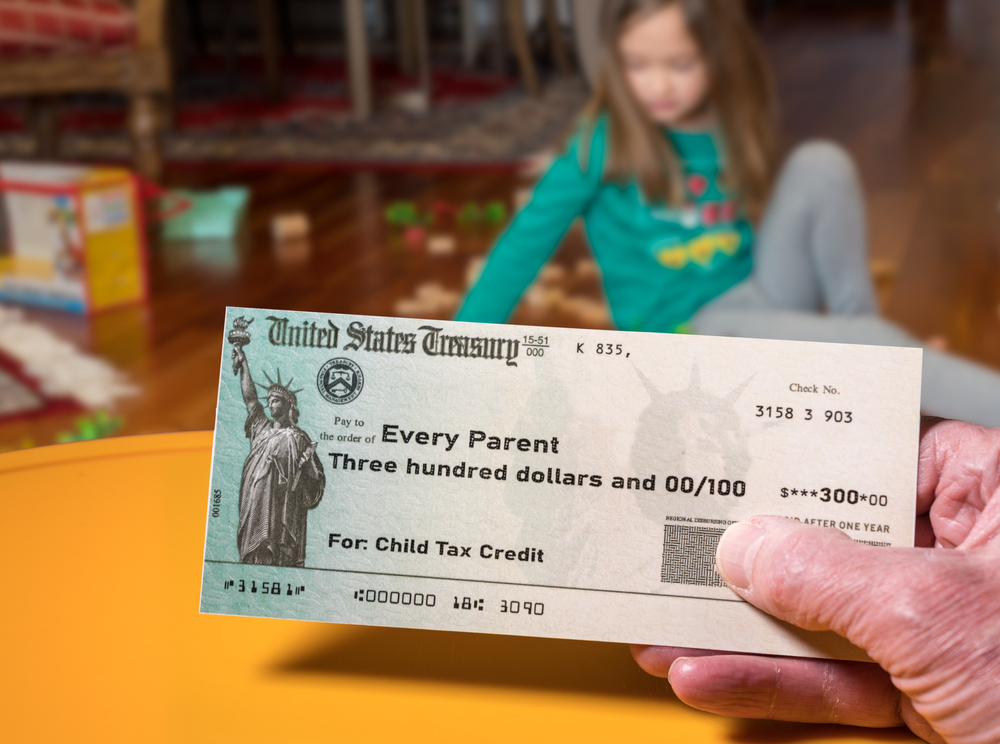

What You Need to Know About the Advance Child Tax Credit

By US Tax Shield |

The excitement continues to build as the new Advanced Child Tax Credit launches. The advance child tax credit payments could ...

What You Need to Know About Increased IRS Funding

By US Tax Shield |

When a new President comes into office, we expect a lot of changes to happen in federal policies and legislation. ...

Your Guide to Tax Resolution

By US Tax Shield |

Suppose you're dealing with the IRS collections process and the related penalties and consequences that come with that. In that ...

How to Get a Refund on $10,200 Unemployment Tax Break

By US Tax Shield |

The Internal Revenue Service recently announced that it will automatically adjust tax returns and refund issues for taxpayers who filed ...

The 2021 Tax Season: It’s Time to File

By US Tax Shield |

The tax season deadline is rapidly approaching, and that means it’s time to prepare and file your taxes as soon ...

Important Reminders as the 2020 Tax Deadline Nears

By US Tax Shield |

Tax season is officially here. Are you prepared? Given the pandemic, this is one of the nation's most important filing ...

The IRS Delays the Start of the 2021 Tax Filing Season

By US Tax Shield |

The Internal Revenue Service recently announced that the nation's 2020 tax season will begin on February 12, 2021. Typically, the ...

Identity Theft: What is it and How to Prevent it

By US Tax Shield |

The Federal Trade Commission estimates that 9 million Americans are victims of identity theft each year. Identity theft occurs when ...

IRS Offers Taxpayer Relief Initiative

By US Tax Shield |

2020 has been a challenging year for many of us. With natural disasters and a global pandemic, the IRS is ...

The Home Office Tax Deduction for Small Business Owners in 2020

By US Tax Shield |

If you use part of your home for your business, you may be able to take the home office deduction. ...

Don’t Miss Your Tax Extension Deadline

By US Tax Shield |

The tax filing deadline moved from April 15th to July 15th in 2020 due to the pandemic, for which more ...

What To Do If You Can’t Pay Your Taxes

By US Tax Shield |

If you can't pay your taxes, don't panic! You're one of millions of taxpayers who have struggled to pay the ...

2019 Tax Deadline Nears: Are You Ready?

By US Tax Shield |

The new July 15 Tax deadline is quickly approaching. Are you ready? Let’s take a look at important tax information ...

Tax Tips for the Unemployed and Furloughed

By US Tax Shield |

As the impact of coronavirus continues to ravage the country, the number of people filing for unemployment is off the ...

Coronavirus Stimulus Payments and Tax Relief: What You Need to Know

By US Tax Shield |

As the COVID-19 situation continues to sweep across the entire globe, millions of Americans are not only worried about their ...

IRS confirms tax filing season to begin January 28

By US Tax Shield |

Despite the government shutdown, the tax filing season will start on January 28. Refunds from the IRS will be processed ...